Imports play a very important role in our country, as we tend to import raw materials / Resources which aren’t available in India. Imports Fix Supply and demand gap.

What is Imports?

Import is basically when you buy the goods from Foreign countries to sell the stuff in India. You will never see a Body called “Import Promotion council” Because no Country wants to become an Importing country, as it involves outward remittances.

Why to Start Imports Business in India?

All across the Global market in a country, both, Exports & imports do happen in order to Stabilize the supply and demand gap in its country. Some countries produce a product more than the requirement in their country & hence they try to export the stuff which is excess so that it can help farmers to get the right price for their product ( In case of Commodities ), In some countries, the country is totally dependent on Imports as that country doesn’t have resources to produce it.

- Fix the Resources: We end up importing the Goods because we want to be an intending business people to help our Home country with the Resources or Raw materials that aren’t available in the country. Fixing the resources is very important to help sectors or industries to help them keep running their show which enables them to run their industry which leads to employment. (A long chain, but this is the end result).

- Supply & Demand gap: Importing plays a very important role in stabilizing the market needs. Supply & demand generally comes when the country fails to produce the goods due to Natural calamity, Pandemic times, Non-Resource availability, Trade wars, etc. In this crisis, the Home county is affected by not having supply as per the demand in the market, When the importers Dive in we try to import the goods as a raw material or the final product as per the market demand. One of the other aspects to look at is, some of the products we produce & those are available only during that period & for the rest of the months, we import it to fulfill the local demand. Eg: Apple, Almonds, etc.

- Trading: This is one of the most common ways of venturing into import business, as by studying & researching our home country market, we could analyze that this product is 100% imported, we don’t produce nor we manufacture it.

- Understand the culture: the other aspect of importing stuff from other countries is basically learn & educate ourselves on what is their culture, by comparing the same product how we use it in our country and how the same product is used in their country. For E.g. Coconut water what we have it in India is different from the ones in Thailand (hope many would have visited by now, if not You should :P)

One of the beauties in imports is you exactly get to know the market demand & how much you earn, if you follow the protocols in imports business as per government regulations. Imports can always be super cool if you have a Good supply chain created in your local market.

What is the license required to Start Import Business in India?

Forming an Import business in India is easy & very much affordable. Below is the license you require to Kick – start import business:

- GST CERTIFICATE

- Import Export Code (Both export & import)

Apart from the above general license you need to also get the license with respect to the product specific (If any) to start importing. For E.g. If you want to import Electrical products in India you need to get a BIS approval apart from the above licenses.

How to Start Import Business in India?

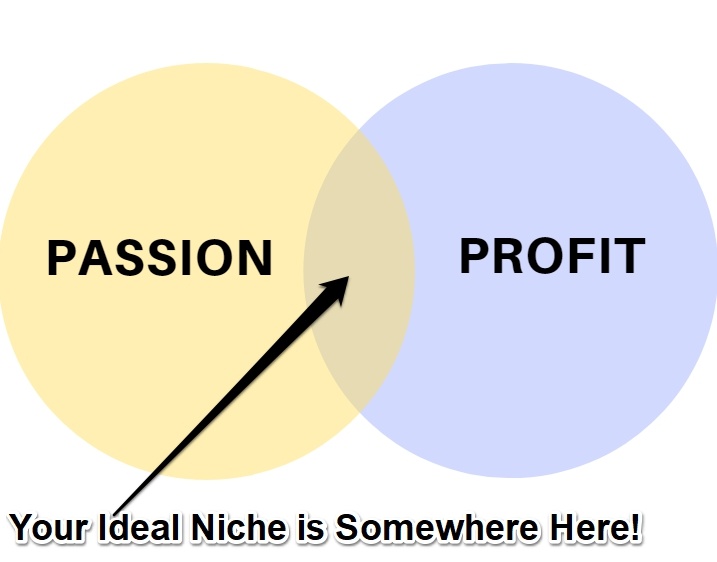

Step 0: Choose the Niche.

This is very important step before you even start importing the goods. This is one of the step where you understand what does our market requires and you try to Fulfil them. You can finalize them through studying various data the no. of inflow of products as well as what does your market require at this point of time. Selecting a niche is directly proportional to two things. A}. Your network or supply chain you have created in the market. B}. What is the demand here?

Step 1: Market selection.

This is the other important aspect of the imports, when you import the stuffs, and that stuff is not what your Target market is looking at, I hope you know that feeling. So, wherever you ae whoever you are, you need to study what market is expecting, what is it up to, how much stock is still available. Market selection in imports means What is by Differentiating through the use of your product in that market by tier 1 , tier 2, tier 3 etc.

Step 2: How to generate Buyers?

Generation of the leads either marketing the goods locally or internationally is important. I may suggest that before the goods arrive premier it in your network that this product is available & create a surprise & a Demand so that before the actual products comes you are generating a curiosity among your local buyers. As soon as product arrives your stuff would be sold out or stocked out. Generating the buyers for B2B trade is You can join Indiamart, tradeindia. But the best is having your website and promoting your stuffs right from your website has a lot more authority then depending on XYZ companies to generate leads for you. The best way to generate leads for the imported products are directly through Online – Social media as well as through google. Ofcourse if you are already having a existing network, Go for it try building a tribe around it and Start marketing the stuff Loud and clear.

Step 3: Quotations & Costing

This is ultra-important view which any importers need to take into consideration before they end up giving purchase order to their supplier. Whenever you think of importing the product from their country, you will definitely know the cost of the product, but many don’t consider the other costs and end making a loss in their consignment. Once after getting the quote from your supplier, you need to first sit across the table with your CHA (Customs house agent) who will be able to tell you what is the import duty on your product as well as the documentation required to release the consignment from the customs. Don’t trust any online informations regarding this as you will end up getting worng figures for which the results would be a loss in your margins. Never ever consider the online quotes in Customs duty. To get a crystal clear view of this is to sit with a CHA and understand the charges. Import tax consists of Basic customs duty ( BCD ) + Countervailing Duty ( CVD ) + GST , If you are importing the stuff which is already available in Indian market and effecting the local manufacturer or Producer you are entitled to pay – Anti – Dumping duty. Customs duty changes every single month and the dollar rate which is considered in imports is +Rs 1 than exports. Lets if the dollar V/S INR today is Rs 65 in Bank, in exports it will be considered the same, but in imports as per customs it will be Rs 66.

Step 4: Which is the Safest Payment terms in Imports?

Never ever pay anyone in this world in advance unless and until you know him personally or you have faithful contact in that country, otherwise you get screwed up. One of the safest level of handling the payments in Imports is opt for Letter of Credit ( L/C) Which is safer for both the sides in order to initiate the trade for the first time, over the period of time, you can start negotiating the payments as Documents against payment on a mutual understanding.

Step 5: What are the Risks Involved in Import Business?

man finger about to press an analysis push button. Focus on the blue led. Concept image for illustration of risk management or assessment.

There are two things which brings out a insecurity to a importer in any time, First being Payment gurantee, which means if he/she had made the payment what is the guarantee that the product would be shipped from there, Lets say even if you open the L/C if products aren’t shipped, Hope you feel the heat here, you would be screwed up with the bank charges without earning a penny in it. So the most important point is first come to a mutual understanding that you want the product like this in a crystal clear way in the contract and you strongly agree to it, without having any difference in opinion between you guys. Second being, the quality, This is the utmost point where you monetise in the business, if the desired quality isn’t arrived you basically cannot expect the market to take up your goods at the specific rates which you have calculated before the arriving of the goods, So here the specifications of the goods should be mentioned on a transparent way so that this has given the first preference on to the Prices. You can also opt in for a third-party inspection agency like SGS to do the inspection on behalf of you and get the Certificate as a proof. The third being, If you are into commodity trade let’s say for E.g.: Onions, If the desired product doesn’t come up to your hands within the stipulated period you end up being at loss because your buyers would have already got the materials and the market is flooded with the goods which in turn brings down the price. All the communication should be in emails and documented. I am sorry to state that our government in no way can help you out even if the supplier defaults the payment because the it’s a outward remittances, so be careful while importing it is onto your sole interests & risk you are importing it. Don’t ever do Under-invoicing, if you are caught it will be subjected seizure of the goods.

Step 6: How to Handle Logistics in Imports Business?

This is the other end of talking about importing the goods. There are two cases which is normally seen, One such case is your supplier has the export license in his country they ae able to ship the goods as per the shipping terms agreed (CIF) you just need to settle the bills and they are going to handle the shipping for you, which is pretty much simple. The other case being, You go to a market and pick the product from the market directly, in this case the supplier isn’t a exporter but a local supplier then you need a consolidator & a shipping company who has office / agents in both the countries so that you are on a safer track. This shipping terms is called as FOB. So either of the case you can use the shipping terms in order to import the stuff and get it delivered. The other being the Drop shipping through E-Commerce, Where you try to import it through them on a limited volumes just for a trial, they ship it as per your requisite information right at your Home address / office address, in this case some consignments are subjected to pay for import duty and some are not. This decision is solely taken up the Customs authority as per the use & the volumes you have brought.

Conclusion

I hope you have by now got a clarity on Imports business in India & Off course how to take on to the next step with your Imports Journey.

Let me know about your journey in Imports business below in the Comment Box.